Posted on July 6, 2020

(*in English)

・Course group: Professionals and Value Creation

・Course Name: TAL.S502 Professionals and Value Creation I

・Program Name: How does the evolving FinTech affect finance and society? Part I

・Guest speaker: Hideshi Roger Hoshino, Japan Country Head, Finetiq Limited

・Date & Time: 19/Jun (Fri) 18:00-19:30

Lecture details

On June 19th, Roger Hoshino, a Japan Country Head of Finetiq Limited had joined 22 ToTAL and OPEN students in a discussion about FinTech and cashless society over ZOOM. The students came well-prepared – some of the students have already made presentations about the topic and educated the rest. But even though you can learn some information on your own or from a presentation made by other students, what really helps one understand the topic is real-life experience, and Roger had a lot of it to share with everyone.

Japan vs the World

The main topic of the day was “cashless society”, and it’s well-known that paper money is still a domineering force in Japan… But is it really that bad?

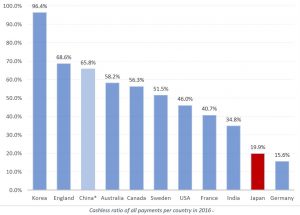

Turns out that the answer is yes – while its neighbor Korea is leading the world with using cashless payments 96% of the time, Japan is trailing behind most other countries, only using cashless 20% of the time.

There are reasons to other countries being ahead: Korean government started promoting cashless payments back in 1997, the US invented the credit card and was a starting ground for many e-payment services like PayPal and Apple Pay, and Australia completely removed paper tickets from their transportation system in favor of using IC/debit/credit cards.

But Japan had those things as well!

The country was one of the early adopters of the credit card system (first credit card service, now JCB, was founded back in 1961 when they were invented in 1950 in the US), and almost everyone uses IC cards to board trains and buses, or even to pay in stores.

Turns out that having and using something are different things – while Japan has a lot of credit card holders (280 000 compared to Korea’s 95 000), only 18% of them actually use their credit cards!

Why is cashless not popular in Japan?

A logical question arises – if the infrastructure for using cashless payments is there, why is nobody using them?

There are multiple answers to this question.

One of the answers is inconvenience – a lot of places in Japan still don’t support cashless payments.

No credit cards welcome!

Small businesses, be it shops or restaurants, either don’t want or can’t afford to pay a recurring fee that comes with owning the equipment needed to process credit cards and other payment methods – which makes some amount of actual money in your pocket necessary whenever you want to hang out with friends or just shop in your neighborhood.

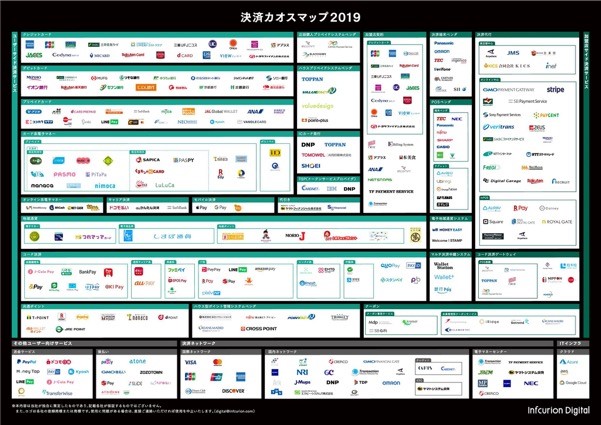

Another answer is that the current cashless system in Japan is very chaotic and hard to understand as a newcomer. Firstly, there are so many different banks and credit card options, then you have different IC cards that are almost (but not) the same, and in addition to that, every large company has its own virtual currency or points!

Having so many options just confuses people (Source)

While it’s good to have a diverse marketplace with a lot of different options if the amount of options is too high it (like you can see in the figure above) just becomes daunting to choose anything.

A possible future (ZHIMA credit)

But what would happen if instead of figuring out why Japan is behind other countries when it comes to cashless currency we tried to look for what may await us in the future?

Roger told us about a service commonly used in China now – ZHIMA Credit (part of Alipay). It collects data about everyone that uses it and incorporates it into a score that determines your “goodness” as a citizen.

If you have a high ZHIMA Credit score, you get access to things like better loan terms, shorter queue times at different establishments, an ability to rent cars and other items without a deposit and even more visibility on dating sites!

The payment QR code changes color depending on whether you’re infected with COVID-19

Not only that, but with Coronavirus around, your QR score that pops up whenever you are paying for something changes color to indicate whether you’re healthy (green), been in contact with a sick person (yellow), or are sick yourself (red).

It is also a useful tool to fight crime – one killer had to surrender to police because he couldn’t show his QR code to anyone, resulting in him being unable to stay at a hotel or even buy food.

While we don’t know how cashless payment will look like in the future, there’s a lot of potential for development in it – and as we can see from ZHIMA Credit, you can do more with e-money than just pay for goods.

Join ToTAL!

This lecture was a great experience to discuss a hot topic with an expert in the area. Why not join us in doing the same with more interesting topics and their respectable experts?

ToTAL classes are open for every Tokyo Tech student to join (email yamada.k.be@m.titech.ac.jp if you want to learn more), and the program of itself gives you a lot of opportunities to grow and develop yourself as a leader!

(Reported by Oleksii Kyrylchuk, M2, Artificial Intelligence, Dept. of Computer Science, School of Computing, and 2019 ToTAL student)